An immediate cash loan despite poor credit is hard to come by! Not any more, as a borrower with a sound equity to release always has a better chance of attaining immediate cash loans poor credit guaranteed approval. A homeowner with poor credits in UK is in an advantageous state than a tenant with poor credits.

Simple, the reason being, the security back up. A poor credit guaranteed loan lender is secured about the loan payment from the borrower. He knows that a borrower will not run scot-free with his security being jeopardized with him. There lies the catch! Poor Credit Guaranteed Approval loans UK are specifically designed to cater to uk homeowners facing poor credits.

Simple, the reason being, the security back up. A poor credit guaranteed loan lender is secured about the loan payment from the borrower. He knows that a borrower will not run scot-free with his security being jeopardized with him. There lies the catch! Poor Credit Guaranteed Approval loans UK are specifically designed to cater to uk homeowners facing poor credits.

What are the common reasons to develop a negative credit or poor credit score?

A borrower may have made a bad choice with his lender and settled down with a high rate personal loan and thus resulted in opting for County Court Judgement to combat loan defaults, missed payments and has accumulated negative credit score. It may have been created by self or by circumstances around him.

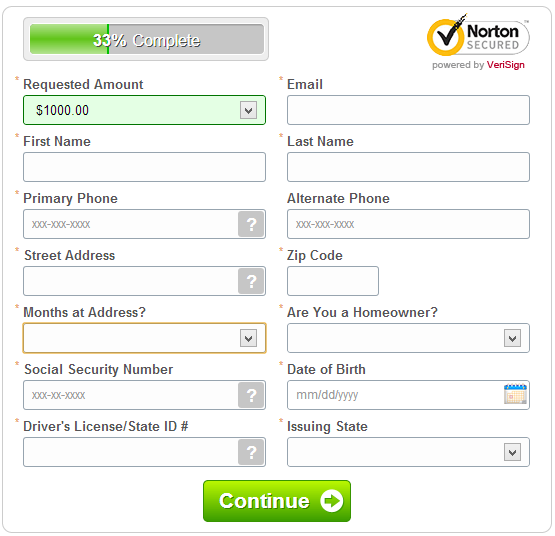

Instant Low Cost Personal Loan guaranteed approval!

But are all loans specially designed for homeowners alone? Not true...immediate cash loans poor credit guaranteed approval is approved without a collateral backed up. Run less risk with no collateral, no credit check immediate decision loans, what more can a tenant with poor credits ask for?

If a borrower has faced County Court Judgement, mortgage arrears, or has defaulted on loan payment it reflects badly on his credit report and he's considered to have accumulated adverse credits. But a poor credit guaranteed approval assures immediate cash loans and a sound equity can cover up the dearth of positive credit scores and can fund your most urgent needs.

Don't let poor credits stay for longer in your credit report. Clear off all multiple unsecured debts with a guaranteed secured personal poor credit loan and fight out bad credits. Don't just tackle debts but enhance your credit scores as well. Bad credit tenant or homeowner loans instant decision is here to help you out.

With no collateral verification and credit check carried out, a borrower's emergent needs are catered to within less time. Immediate cash loans poor credit guaranteed approval is the right solution to cater to financial needs with bad credit score. Ensure that bad credit loan payments are made on a regular basis in order to safeguard the security, in case it's pledged.